Bullion Dealers

To find a registered BULLION DNA™ dealer near you, consult our listings.

Luxurious, elegant and prestigious, platinum stands out as a preferred choice for jewellery. Beyond its physical allure, platinum’s distinct properties, particularly as a catalyst, make it one of the most sought-after industrial metals. Within the automotive industry, platinum plays a crucial role in lowering vehicle emissions.

The demand for platinum is global and diverse. Yet, the breadth of its applications continues to grow. Thanks to platinum-based technologies, platinum also plays a critical role in shaping the decarbonized economy of the future.

Thirty times rarer than gold, platinum is one of the world’s most exclusive metals. Our platinum bullion coins, enhanced with advanced security features, not only offer investors greater access to platinum but also rank among the most trusted options available.

Why buy platinum

Platinum is a relatively recent addition to investment portfolios when compared to gold and silver, which have been used as a store of value for thousands of years – but that does not make it any less desirable.

Platinum’s scarcity, combined with its ever-increasing industrial utility is building a compelling investment case as it is viewed by some investors as a means of diversifying their portfolios.

Thirty times rarer than gold.

Can be sold for cash and is traded in major global markets.

Its industrial applications have nearly quadrupled since 1980.

The least reactive metal known with unique physical and chemical properties.

The Metal of the Future

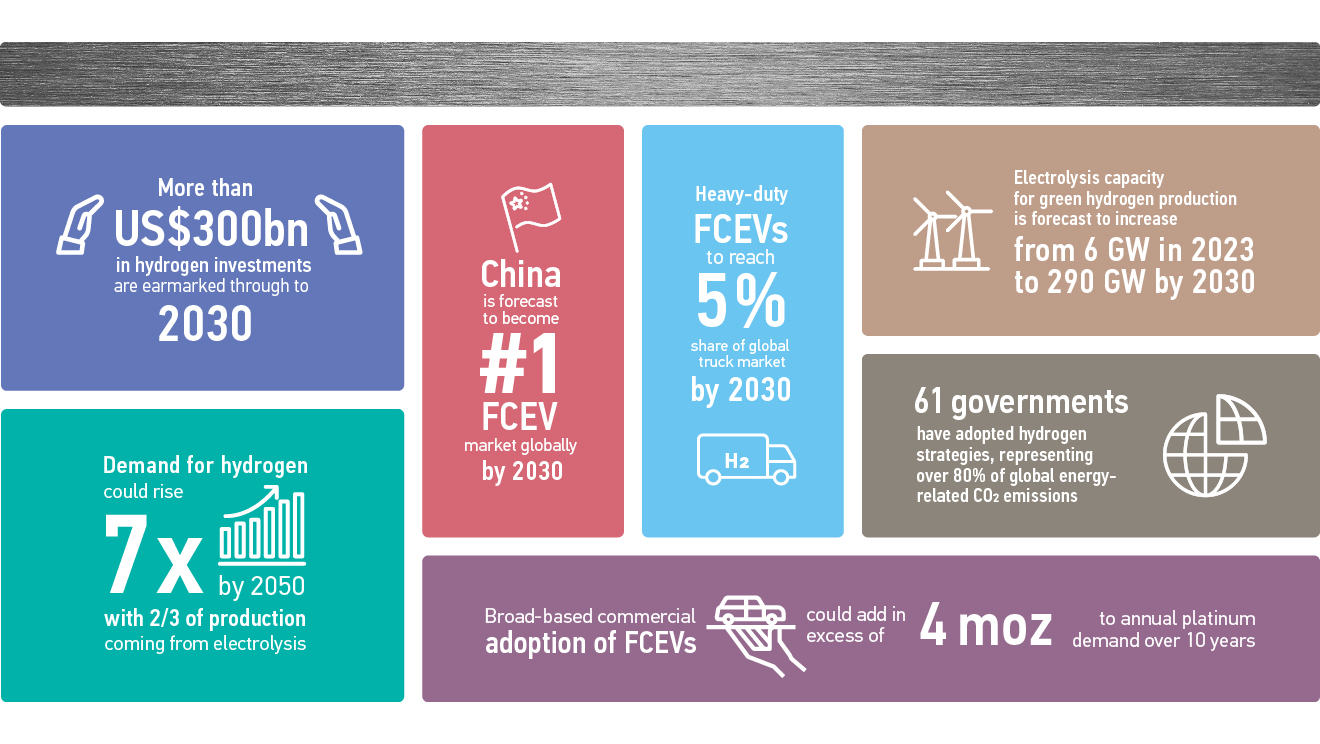

Today’s demand for platinum is driven by four core segments (automotive, industrial, jewellery and investment), but a new driver is emerging as the need to decarbonize increases. What is this new, potential driver for platinum? Hydrogen.

Over 120 countries have committed to achieving net-zero emissions by 2050. To help achieve this goal the world is looking to platinum.

Proton exchange membrane (PEM) technology leverages platinum’s catalytic properties to produce electricity in two key applications: electrolysers and hydrogen fuel cells.

Markets for platinum-based PEM technology are on the rise and one of the major markets is fuel cell electric vehicle (FCEVs). For example, a FCEV powered by hydrogen has zero to no harmful tailpipe emissions – only water vapour and warm air!

Markets at a Glance

Discover more about why and how hydrogen is becoming a new demand driver for platinum.

To find a registered BULLION DNA™ dealer near you, consult our listings.

The links found throughout this webpage will redirect you to a third-party website that is available in English only. By accessing a third-party website, you understand that it is independent from the Royal Canadian Mint (“the Mint”) and that the Mint has no control over the content of such third-party website and cannot assume any responsibility for materials created or published by such third-party websites. In addition, a link to a third-party’s website does not imply that the Mint endorses the website, the information or the content of such website. It is your responsibility to ensure that you review and agree to terms and conditions applicable to such websites before using them. Please note that the Mint is not responsible for webcasting or any other form of transmission received from any linked website.

The information provided on mint.ca (the “Website”) is intended for informational purposes only and is not intended to constitute investment, financial, legal, tax or accounting advice, and you should not rely on the information in this section of the Website for such advice. Precious metal investment may not be suitable for persons unfamiliar with precious metal markets, or unwilling or unable to bear the risk attendant to an investment of this type. Prospective investors should consider carefully before reaching a decision to invest in precious metals.

This section of the Website makes use of words such as ‘could’, ‘continue’, ‘potential’, “expected’, ‘emerging’, ‘ever-increasing’ and words of similar meaning which identifies a statement as ‘forward-looking’. These statements are not guarantees of future performance and should not be relied upon as such. Forward looking statements involve risks and uncertainties, which may cause actual performance in the future to differ materially and substantially from any projections or results expressed or implied by such forward-looking statements. The inclusion of such statements should not be regarded as a representation by the Mint that the forward-looking statements will be achieved.

Prospective investors in precious metals should directly consult their financial professional or other advisors before acting on any information on this Website.

Infographics for ‘lovePlatinum™’ are provided by the World Platinum Investment Council - WPIC®. WPIC does not provide investment advice. Please see disclaimer for more information.